A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Thursday, February 27, 2014

Two Views Of Capitalism’s Global Wobble

A wench, who extols gluttony and lust and is a member of the Mongolian CP, brought a story in the Economist to

my notice. The magazine is revered by the establishment as gospel, is

read with reverence and quoted with awe, so I was curious that it used

terminology and an illustration reminiscent of a thesis and a diagram I

had developed in October 2009 in my essay “Mid stream in a Wobble-U

shaped Recession”. This if it still exists, it is buried somewhere in

achieves of the Sunday Island of 11 October 2009, but fortunately

was included in the booklet “Essays in the Global Economic Crisis”

published by the Institute of Ecumenical Development in December 2010.

The concept was refined in South Asia Analysis Group (Paper 4574 of 29

June 2011).

A wench, who extols gluttony and lust and is a member of the Mongolian CP, brought a story in the Economist to

my notice. The magazine is revered by the establishment as gospel, is

read with reverence and quoted with awe, so I was curious that it used

terminology and an illustration reminiscent of a thesis and a diagram I

had developed in October 2009 in my essay “Mid stream in a Wobble-U

shaped Recession”. This if it still exists, it is buried somewhere in

achieves of the Sunday Island of 11 October 2009, but fortunately

was included in the booklet “Essays in the Global Economic Crisis”

published by the Institute of Ecumenical Development in December 2010.

The concept was refined in South Asia Analysis Group (Paper 4574 of 29

June 2011).

There are substantial paradigm differences between my analyses and the Economist.

Mine was a theory of why global capitalism entered a period of

prolonged crisis and argued that it would be unable to pull out of this

hole for a long time. Indeed, a sustained recovery has still to emerge

though five years have elapsed since the September 2008 debacle. Brief

upturns in America and Europe are followed by disappointing lapses; it’s

a wobble at the bottom like a drunkard in a ditch. Recovery, by

definition a sustained process, is nowhere in sight.

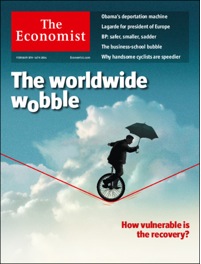

The Economist, on the other hand, takes a sanguine view of the

global economy in its leader of 8 February, “Global economy: World wide

wobble” and a longer piece: “The world economy will have a bumpy 2014;

but the recovery is not, yet, at risk”. I have reproduced my conceptual

diagram of 2009 and the Economists cover page for comparison.

Notwithstanding the use of ‘Wobble’ terminology the gap is striking. I

will summarise my theory in a moment. The Economist has no

paradigm; both pieces are exercises in empiricism; look at data, note

trends and make projections. Methodologically they are pencil and eraser

exercises; keep a straight-edge on a data-set and draw trend-lines. It

is whistling in the dark, hoping for a recovery albeit with

fluctuations.