A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Thursday, June 11, 2015

George Osborne signals RBS selloff at Mansion House speech

Sale of bailed-out bank’s shares at present prices means a £13bn shortfall for taxpayer from 2008 part-nationalisation

RBS was bailed out in 2008 by the taxpayer. Photograph: Toby Melville/Reuters

Jill Treanor-Wednesday 10 June 2015

George Osborne signalled on Wednesday night he was ready to start selling off the Royal Bank of Scotland, seven years after it was rescued from collapse by the taxpayer.

The chancellor said the timing was right for British business and

taxpayers to start selling off part of the 79% stake in the

Edinburgh-based bank, even though the shares are worth £13bn less than

the state paid for them during the financial crisis. The shares will be

sold to major City institutions in the coming months. An offer for

members of the public, as has been promised for Lloyds Banking Group, could follow.

Osborne also backed a move by the Bank of England governor Mark Carney

to impose tougher punishments on bankers who rig markets. Carney warned

City traders they should face up to 10 years in jail for abusing markets

as he pledged to end “the age of irresponsibility” that has gripped the financial sector.

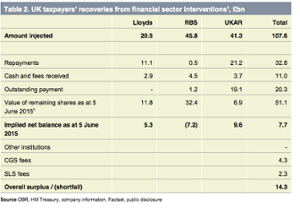

The government pumped £45bn into RBS in 2008 to stave off bankruptcy and

the taxpayer’s investment is now valued at £32bn. The sell-off could

take “some years and will likely involve all types of investors”,

Osborne said.

Speaking to an audience of top bankers at London’s Mansion House in the

heart of the City, the chancellor said the government would still make a

£14.3bn profit on the rescue programme for banks. This figure is

reached by adding in the proceeds of share sales from Lloyds, along with

cash generated from Northern Rock and the mortgage arm of Bradford

& Bingley, which were also rescued during the financial crisis.

“It’s the right thing to do for British businesses and British

taxpayers. Yes, we may get a lower price than Labour paid for it. But

the longer we wait, the higher the price the whole economy will pay,”

said Osborne.

“And when you take the banks in total, we’re making sure taxpayers get back billions more than they were forced to put in”.

By signalling a sell-off of the RBS stake, the chancellor is hoping that

City investors will be encouraged by the diminished prospect of the

government meddling in the bank. The shares closed on Wednesday night at

354p, below the 502p average price paid for them during the crisis.

Osborne presented his case for a sell-off after commissioning a report

from investment bankers at Rothschild and seeking the advice of Mark

Carney, the governor of the Bank of England. Rothschild concludes that

RBS shares may never return to their pre-crisis levels and the current

share price “fairly reflects the fundamental value of the bank”.

Rothschild’s analysis on bailed-out banks. Photograph: Rothschild/Rothschild

Rothschild’s analysis on bailed-out banks. Photograph: Rothschild/Rothschild

Osborne blamed the bailout on Labour. “I was not responsible for the

bailout of RBS or the price paid then for shares bought by the taxpayer:

but I am responsible for getting the best deal now for the taxpayer and

doing whatever I can to support the British economy,” he said.

In a letter to Osborne, published on Wednesday night, Carney said:

“Continued public ownership without a foreseeable endpoint runs risks

including limiting RBS’s future strategic options, and continuing the

perception that taxpayers bear responsibility for RBS losses. In these

regards, there could be considerable net costs to taxpayers of further

delaying the start of a sale.”

Two years ago, Osborne used his Mansion House speech to signal a sell-off the stake in Lloyds, which then stood at 43% and on Wednesday fell to below 18% after more shares were sold on the stock market. In his 2011 speech, he put Northern Rock up for sale, and a deal was later clinched with Virgin Money.

The analysis by Rothschild concludes that a multibillion-pound lawsuit that RBS faces from the US authorities relating to the subprime mortgage crisis and expected later this year will not damage the bank’s fragile share price.

Unveiling his plan to clampdown on rogue bankers, Carney referred to the

$150bn (£96bn) worth of fines that have been imposed on major global

banks since 2008. He said these had deprived the worldwide economy of

$3tn of credit. The misdeeds had raised borrowing costs, led to

companies holding back investment and dissuaded people from moving home,

he said.

He set out plans to inject more regulation in the fixed-income, currency

and commodities (FICC) markets that have witnessed many of the recent

fines for market rigging, including a market standards board to draw up

and police codes of conduct.

“For the best of the industry this won’t be new. This is just how you

run your business. But for others who free-ride on your reputations: the

age of irresponsibility is over,” said Carney.

Osborne added: “The public rightly asks why it is after so many

scandals, and such cost to the country, so few individuals have faced

punishment in the courts.”

The chancellor also set out terms for the UK’s renegotiation of EU membership.“Among

the principles we seek to establish in this renegotiation are these

simple ones: fairness between the euro-ins and the euro-outs enshrined,

and the integrity of the single market preserved,” he said.

Osborne, who last night sanctioned a further sell-off of Royal Mail, said 1% was being kept back for the company’s employees. More details are expected on Thursday.