A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Thursday, April 7, 2016

Will Sri Lanka Wake Up To The Realities of The ‘Panama Papers’ Exposure?

By LUKMAN HAREES-

Featured image courtesy AFP/GETTY – Rodrigo Arangua

On April 3, 2016, Suddeutsche Zeitung, Germany’s largest daily newspaper leaked 11.5 million files from the database of Mossack Fonseca,

a law firm headquartered in Panama City, Panama. The firm is one of the

world’s top creators of shell companies, corporate structures that can

be used to hide ownership of assets. The files exposed financial

dealings of some of the world’s richest and most powerful individuals.

The documents included financial records, legal documents such as

passports, and correspondences dating back over 40 years ,which reveal

offshore accounts of current and former world leaders as well as

individuals with close ties to political figures and business moguls

around the globe. The files also revealed that it is not only

politicians who are found to be tied to the alleged laundering of funds

but many celebrities, professional sporting stars and even sporting

bodies too. Now that the door is open, new revelations are bound to come

forward to expose the depth of the Panamanian corruption scandal. The

release of the Panama Papers is thought to be merely ‘Chapter One’ of a

much more serious and larger case.

On April 3, 2016, Suddeutsche Zeitung, Germany’s largest daily newspaper leaked 11.5 million files from the database of Mossack Fonseca,

a law firm headquartered in Panama City, Panama. The firm is one of the

world’s top creators of shell companies, corporate structures that can

be used to hide ownership of assets. The files exposed financial

dealings of some of the world’s richest and most powerful individuals.

The documents included financial records, legal documents such as

passports, and correspondences dating back over 40 years ,which reveal

offshore accounts of current and former world leaders as well as

individuals with close ties to political figures and business moguls

around the globe. The files also revealed that it is not only

politicians who are found to be tied to the alleged laundering of funds

but many celebrities, professional sporting stars and even sporting

bodies too. Now that the door is open, new revelations are bound to come

forward to expose the depth of the Panamanian corruption scandal. The

release of the Panama Papers is thought to be merely ‘Chapter One’ of a

much more serious and larger case.

Analysts comment that these findings show how deeply ingrained harmful

practices and criminality are in the offshore world and that the release

of the leaked documents should prompt governments to seek “concrete

sanctions” against jurisdictions and institutions that peddle offshore

secrecy. The documents reveal that Mossack Fonseca, far from being an

aberration, was an integral part of the operations of leading global

banks. As the International Consortium of Investigative Journalists (ICIJ) puts

it, “The documents make it clear that major banks are big drivers

behind the creation of hard-to-trace companies in the British Virgin

Islands, Panama and other offshore havens. The files list nearly 15,600

paper companies that banks set up for clients who want to keep their

finances under wraps, including thousands created by international

giants UBS and HSBC. This leak is thus proof that despite explicit

banking laws against tax evasion, criminal uses and money laundering,

the global offshore shell game business remains open for the wealthy and

well connected to exploit.”

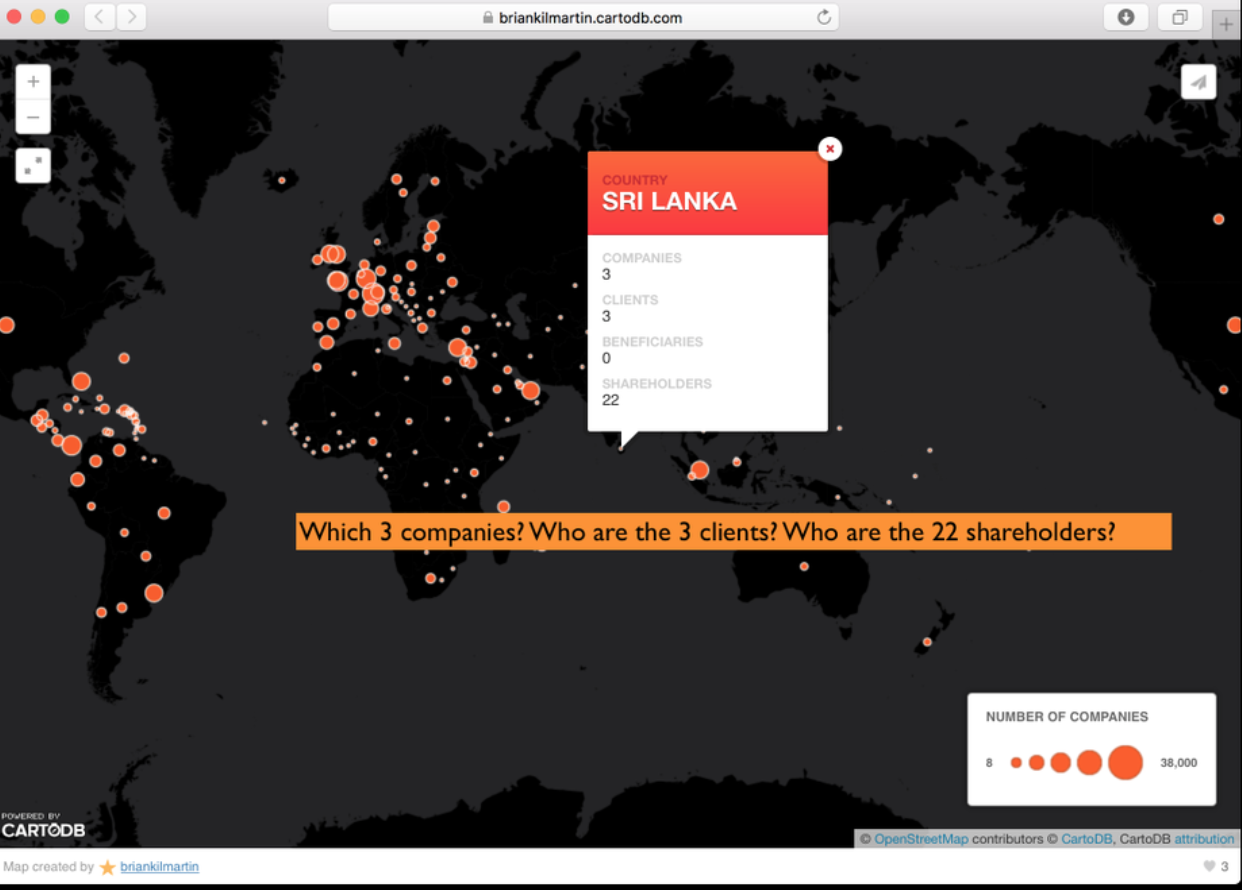

This state of affairs bears much direct relevance to Sri Lanka as well, as the map, published by the Irish Times, titled as ‘secret companies around the world’ indicates that there were 3 Sri Lankan companies too which were listed in the report with 3 clients and 22 shareholders.

Therefore, there is direct interest for Sri Lanka to investigate further

regarding this exposure about Sri Lankan companies and entities being

named in this controversy. The Government should however not just limit

their interest to a full detailed exposure of those companies and

personalities involved, but also ascertain the extent of the tentacles

of corruption and money laundering followed by politicos and businesses

in stashing their ‘ill-gotten’ wealth abroad. One of the largest

protests in Iceland’s history demanding Prime Minister Sigmundur

Gunnlaugsson to step down after the leaked files revealed he and his

wife were hiding investments worth millions of dollars behind a

secretive offshore company, has much resonance to all of us following

political developments in Sri Lanka.

Mangala Samaraweera went on record some time back saying that Sri Lanka

had already secured support from four countries to track an estimated USD 18 billion in assets stolen

by former president Mahinda Rajapaksa and his family. The US and India

had previously announced they were helping Sri Lanka’s new government

track down stolen wealth stashed abroad, allegedly hoarded in tax

havens.

Yet the start of the Maithripala-Ranil era too smacked of corruption. One prime example was the Central Banks Governor’s alleged

shady deal, which dented this Government’s credibility to a great

degree. It is therefore vital that the new government too, reads their

mandate correctly, as it was the result of the winds of political change

which swept through Sri Lanka in 2015. People demanded a clear plan of

action to bring in good governance, transparency and accountability; not

just small doses of them. Of course,

investigative and law enforcement arms such as the Financial Crimes Investigative Division (FCID) and the Commission to Investigate Allegations of Bribery or Corruption (CIABOC)

were set up and/or strengthened. It has been a routine daily news

bulletin item in the post-January 2015 period, with many parties

submitting petitions to the Commission and the Police subsequently

arresting and releasing various culprits. These staged dramas, now

almost a source of public entertainment rather than showing any

significant results, have made the public question whether the ‘Yahapalanaya’

promise to have zero tolerance’ to corruption is merely an eye wash or a

serious commitment to clean the stables and ensure a clean political

culture.

Of course, there are noticeable improvements in accountability and

transparency and press freedom, arming people with knowledge about how

political leadership is managing public finances. However, people are

quite rightly demanding concrete steps to achieve the ideal of zero

tolerance to corruption; not just ‘flash in the pan’ marginal

improvements to attract public attention or gain short term cheap

political mileage by hunting down political opponents. The public also

needs to know about the progress of the government’s drive to track down

the nation’s wealth allegedly stashed abroad, which was a major

campaigning point during election time.

Sri Lanka was ranked 83rd out of 175 countries, according to the 2015 Corruption Perceptions Index reported

by Transparency International. Sri Lanka’s corruption Rank averaged

81.79 from 2002 until 2015, reaching an all-time high of 97 in 2009 and a

record low of 52 in 2002. Sri Lanka clearly need to aim for a

consistent plan of action to achieve a higher rating on the

Anti-Corruption Index of Transparency International (TI).

Black money is basically income from which tax has been evaded and tax

havens are territories which provide a safe and easy environment for

such money to come in. Such territories are “safe” because neither do

they ask the depositors where the money is coming from nor do they

share such account information of depositors easily with other

countries. It is a known fact that the flow of black money out of a

country into tax havens of dubious nature, such as Mossack Fonseca in

Panama (reportedly only the third largest in the world and certainly not

the only one) can easily destabilise the financial market of a country.

It is developing countries like Sri Lanka that are impacted more due to

such capital outflows, hence the need to take immediate and stringent

measures to put these practises to an end. It has been estimated that

every year, developing countries lose about $160 billion to such tax

havens. Adopting urgent measures to curb such an outflow of black money

is therefore the need of the hour for Sri Lanka at this crucial point of

time, when there is a new government which has much more

credibility than the previous one. There is clamour from the public and

aspirations are at an all-time high to ensure a clean political culture

for Sri Lanka. Besides, it is also important to reform the vital

institutions of the judiciary and the law enforcement authorities,

particularly the Police, to crack down on corruption and nepotism to

regain public credibility . Perhaps, this is an opportune time to

reflect on this national priority when constitutional reforms are also

on the cards.

Will the Panama papers therefore propel Sri Lanka to go beyond mere

verbosity and put their house in order – to take concrete action to

bring culprits who have siphoned out public funds abroad to their

advantage, to close the legal /financial loopholes and to hold public

representatives to account by ensuring accountability and transparency

on their part? Only time will tell.

However, in the best interests of future generations, Sri Lankans must insist that their government ‘walk the talk’.