A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Sunday, November 6, 2016

To deal with climate change we need a new financial system

Abolishing

debt-based currency isn’t a new idea, but it could hold the secret to

ending our economies’ environmentally damaging addiction to growth

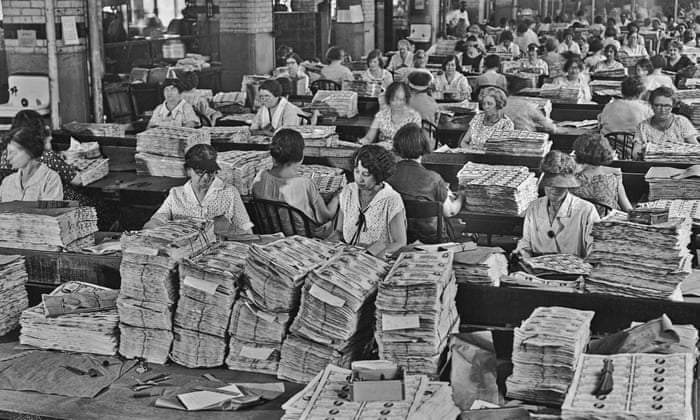

Bank notes are checked in 1929 at the US Bureau of Engraving and Printing. Photograph: FPG/Getty Images

When it comes to global warming, we know that the real problem is not just fossil fuels –

it is the logic of endless growth that is built into our economic

system. If we don’t keep the global economy growing by at least 3% per

year, it plunges into crisis. That means we have to double the size of

the economy every 20 years, just to stay afloat. It doesn’t take much to

realise that this imperative for exponential growth makes little sense

given the limits of our finite planet.

Rapid climate change is the most obvious symptom of this contradiction,

but we’re also seeing it in the form of deforestation, desertification

and mass extinction, with species dying at an alarming rate as

our consumption of the natural world causes their habitats to collapse.

It was unthinkable to say this even 10 years ago, but today, as we

become increasingly aware of these crises, it seems all too clear: our

economic system is incompatible with life on this planet.

Indonesian

officials set fire to a stockpile of illegal items made from endangered

animals, including tigers, sun bears and the Javan gibbon. Photograph:

Jefta Images/Barcroft Images

Indonesian

officials set fire to a stockpile of illegal items made from endangered

animals, including tigers, sun bears and the Javan gibbon. Photograph:

Jefta Images/Barcroft Images

The question is what to do about it. How can we redesign the global

economy to bring it in line with the principles of ecology? The most

obvious answer is to stop using GDP to measure economic progress and

replace it with a more thoughtful measure – one that accounts for the ecological and social impact of economic activity. Prominent economists like Nobel Prize winner Joseph Stiglitz have been calling for such changes for years and it’s time we listened.

But replacing GDP is only a first step. While it might help refocus

economic policies on what really matters, it doesn’t address the main

driver of growth: debt. Debt is the reason the economy has to grow in

the first place. Because debt always comes with interest, it grows

exponentially – so if a person, a business, or a country wants to pay

down debt over the long term, they have to grow enough to at least match

the growth of their debt. Without growth, debt piles up and eventually

triggers an economic crisis.

One way to relieve the pressure for endless growth might be to cancel

some of the debt – a kind of debt jubilee. But this would only provide a

short-term fix; it wouldn’t get to the real root of the problem: that

the global economic system runs on money that is itself debt.

This might sound a bit odd, but it’s quite simple. When you walk into a

bank to take out a loan, you assume that the bank is lending you money

it has in reserve – money that it stores somewhere in a vault, for

example, collected from other people’s deposits. But that’s not how it

works. Banks only hold reserves worth about 10% of the money they lend

out. In other words, banks lend out 10 times more money than they

actually have. This is known as fractional reserve banking.

So where does all that additional money come from? Banks create it out

of thin air when they make loans – they loan it into existence. This

accounts for about 90% of the money circulating in our economy right

now. It’s not created by the government, as most people assume: it is

created by commercial banks in the form of loans. In other words, almost

every dollar that passes through our hands represents somebody’s debt.

And every dollar of debt has to be paid back with interest. Because our

money system is based on debt, it has a growth imperative baked into it.

In other words, our money system is heating up the planet.

Once we realise this, the solution comes into view: we need banks to

keep a bigger fraction of reserves behind the loans they make. This

would go a long way toward diminishing the amount of debt sloshing

around in our economy, helping reduce the pressure for economic growth.

But there’s an even more exciting solution we might consider. We could

abolish debt-based currency altogether and invent a new money system

completely free of intrinsic debt. Instead of letting commercial banks

create money by lending it into existence, we could have the state

create the money and then spend it into existence. New money would get

pumped into the real economy instead of just going straight into

financial speculation where it inflates huge asset bubbles that only benefit the mega-rich.

The responsibility for money creation would be placed with an

independent agency that – unlike our banks – would be democratic,

accountable, and transparent, so money would become a truly public good.

Commercial banks would still be able to lend money at interest, but

they would have to back it dollar for dollar with their own reserves. In

other words, there would be a 100% reserve requirement.

This is not a fringe proposal. It has been around since at least the

1930s, when a group of economists in Chicago proposed it as a way of

curbing the reckless lending that led to the Great Depression. The Chicago Plan, as it was called, made headlines again in 2012 when progressive IMF economists put it forward as

a strategy for preventing the global financial crisis from recurring.

They pointed out that such a system would dramatically reduce both

public and private debt and make the world economy more stable.

What they didn’t notice is that abolishing debt-based currency also

holds the secret to getting our system off its addiction to growth, and

therefore to arresting climate change. As it turns out, reinventing our

money system is crucial to our survival in the Anthropocene – at least as important as getting off fossil fuels. And this idea is already beginning to gain traction: in the UK, the campaigning group Positive Money has generated momentum around it, building on a series of excellent explanatory videos.

The idea has its enemies, of course. If we shift to a positive money

system, big banks will no longer have the power to literally make money

out of nothing and the rich will no longer reap millions from asset

bubbles. Unsurprisingly, neither of these groups would be pleased by

this prospect. But if we want to build a fairer, more ecologically sound

economy, that’s a battle that we can’t be afraid to fight.

Join our community of development professionals and humanitarians.

Follow@GuardianGDP on Twitter. Join the conversation with the hashtag #Dev2030.