A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Thursday, July 27, 2017

Money laundering: Should the Inland Revenue Department play a greater role?

Wednesday, 26 July 2017

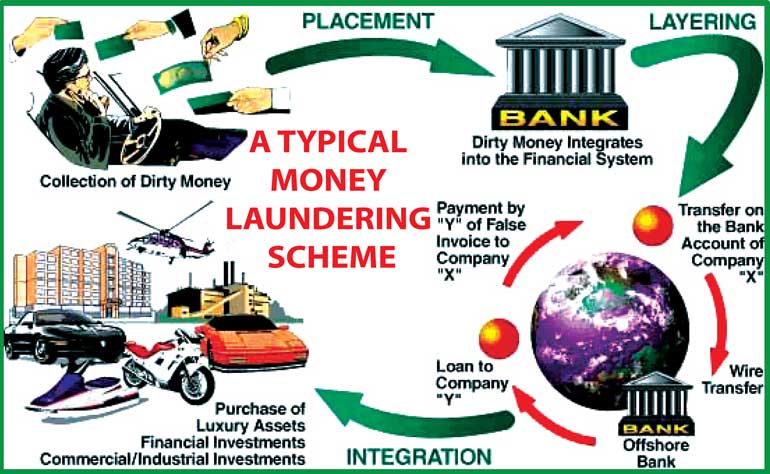

Wednesday, 26 July 2017Money laundering is presently a very timely topic, locally and internationally. A perpetrator of the offence of money laundering could be defined as:

(1) Any person, who— (a) engages directly or indirectly in any transaction in relation to any property which is derived or realised directly or indirectly, from any unlawful activity or from the proceeds of any unlawful activity; (b) receives, possesses, conceals, disposes of, or brings into Sri Lanka, transfers out of Sri Lanka, or invests in Sri Lanka, any property which is derived or realised, directly or indirectly, from any unlawful activity or from the proceeds of any unlawful activity, knowing or having reason to believe that such property is derived or realised, directly or indirectly from any unlawful activity or from the proceeds of any unlawful activity, shall be guilty of the offence of money laundering.’1

In short, it is the money engineered from any illegal activity. This income is generally linked with mass criminal activities. Earlier drug trafficking was the primary source, yet now it is estimated that terrorism is the foremost criminal offence. However, the money is ‘laundered’ to appear to be legitimate and not originate from criminal activity. To quantify the income from money laundering is relatively speculative, though it has been roughly estimated that $1.5 trillion is the amount generated annually.

Tax evasion, however, is an issue at hand and must be addressed aggressively. Tax paid by citizens to their country is paramount as it contributes to the development and growth of the nation. Sectors like education, health and transport are largely funded by the government and need constant generation of funds. Also when the superfluous outsource their ‘ill-gotten’ income, the bulk of the tax income falls on the middle and lower income groups which is a huge burden for them and it becomes a vicious cycle consequently, where in the long run the rich are getting richer and the other income groups are barely making ends meet. The frustration of a government is also visible when each year they are compelled to keep increasing the taxes.

The golden question though is that, irrespective of whatever measures are taken, criminal activities like money laundering will keep perpetuating and if the primary goal of the government to stop this activity is impossible, what would be the most efficient manner of dealing with it?

When discussing ways of punishing criminals involved in money laundering, evidently, the first stage would be to confirm evidence that it is ‘laundered’ income. If this is done, then the due process of criminal investigation and prosecution would take place and the money would be confiscated. However, since most of this income is concealed in legitimate businesses and is accounted as profits from these businesses, and if the ‘illegal’ source is unknown, then, inadvertently this income does get taxed as a part of the company taxes being paid.

However, another interesting point of debate is, when a money laundering activity has been exposed and the ‘laundered’ money has been confiscated, should it be taxed, as civil forfeiture?

Peter Allridge in his book, ‘Money Laundering Law’, explores this theme comprehensively. He states that, ‘Traditionally, agencies for taxation and criminal justice have kept their respective information separate. When tax inspectors have come into possession of information that a taxpayer profits from crime, they have not been allowed to inform the police, and they have not been allowed to raise assessments to income tax without specifying a source from which the income comes….the use of the power to raise an assessment to taxation against a person with visible wealth, but no visible lawful source of income, is a new departure. Its advocates regard it as an exercise in integrating the official response to tax evasion and money laundering – in ‘joined-up government’. Its detractors see a sinister attempt to aggregrate the already intrusive powers of different branches of Government and place citizens continually under an obligation to justify themselves and their possessions to the State.2

But in most instances, the income generated is concealed of its criminal origin. The question remains, then, that if there is suspicion, whether there should be a duty of care on the Assessor, as much as on the banker and the auditor.

A very relevant article to this issue was published by Dr. Shivaji Felix, titled “Rights Consciousness in Taxation”3, where he explored the duties of an Assessor. Section 134 (3) of the Inland Revenue Act No. 38 of 2000, explicitly provides for a statutory duty to give reasons when a return of income is rejected by an Assessor. The section goes as follows:

“Where a person has furnished a return of income, the Assessor may in making an assessment on such person under subsection (1) or under subsection (2), either –

a. accept the return made by such person; or

b. if he does not accept the return made by that person estimate the amount of the assessable income, of such person and assess him accordingly:

Provided that where an Assessor does not accept the return made by any person for any year of assessment and makes an assessment, or additional assessment on such person for that year of assessment, he shall communicate to such person in writing, his reasons for not accepting the return.”

In Fernando v. Ismail4 the State contended that the taxpayer had furnished a false return. However, Samarakoon C.J., expressed the view that falsity was a conclusion arrived at by the Assessor. It was a conclusion arrived at by a process of reasoning based on data available to the Assessor. He went on to say in his judgement,

“….the section requires reasons for non-acceptance of a return which is an act of the Assessor. It is his thinking that has to be disclosed to the Assessee. No doubt there may be cases where the reasons for non-acceptance may be obvious but one must bear in mind the fact that the legislature has made no exception to the general rule and the duty cast on the Assessor must be carried out even though the Assessee himself accepts the obvious.”

This judgement has been consolidated in our laws. In New Portland Ltd v. Jayawardena5 the Court of Appeal did not hesitate to follow the majority decision of the Supreme Court in Fenando. In the New Portman case, the Assessor rejected the return on the basis that the statement of accounts, which accompanied the return, was false. However, it was considered paramount the he provide reasons for the rejection.

The concept of using taxation as a weapon against crime is not new. The Hodgson Committee wrote, ‘This way of treating people who have offended against the criminal law has attracted judicial praise for its efficiency and cost effectiveness.’6

Alldridge continues to explain this7, “There are good reasons why taxation should be used as the principal means by which to recover income derived from crime. First of all, it may be more effective in generating revenue than confiscation. This is the Irish experience. Second, the powers that the Revenue has in some respects exceed those of the police….If the objectives of the Inland Revenue are simply expressed in terms of efficient collection of taxes, however, the tax authorities, have every reason to avoid pursuit of alleged criminals, because in terms of revenue per unit spent on enforcement, the criminal is not a rewarding target. The development of the ‘joined-up’ project may involve the deployment of powers that have the less damaging initial objective of taxation (and which need not be subject to such rigorous procedural constraints) to the more damaging end of generating evidence for criminal prosecutions. In this sense each join requires a separate and sufficient justification.”

So, in relevance to money laundering, in conjunction with the Inland Revenue Act and these judgments, I strongly believe that along with bankers and auditors, who are anyway trained and given authority to raise caution if there is a sum of money which is questionable, assessors too should be given that impetus to investigate, report and query, if need be.

Also it should be borne in mind that as globalisation is increasing and the world is getting more interconnected, it is important to realise that not only do domestic policies affect the country concerned, but the enforcement or the lack of enforcement of domestic policies affect globally. As much as money laundering is a criminal offence, it also involves huge amounts of money and thus can also be categorised as a financial regulatory concern. It is imperative for the police to investigate and prosecute. However I strongly believe that bankers, auditors and assessors need to increase their role in combatting this crime.

[The writer, LL.B (Hons.) (Warwick), Barrister (from Lincoln’s Inn), is an Attorney-at-Law.]

Footnotes

1Prevention of Money Laundering Act 2006 s.3 (a) and (b)2 Alldridge, P; ‘Money Laundering Law’; Hart Publishing 2003

3 The Junior Bar Law Journal, 2005 Volume I

4 [1982] 1 Sri L R 222 (SC)

5 [1989] 1 Sri L R 307

6 Op cit, Alldridge, Pg 247, citing Hodgson Report pp72-73

7 Ibid