A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Wednesday, January 24, 2018

Yahapālana Government As A Hyper-Debt Regime

By Milton Rajaratne –January 23, 2018

Government

debt, as an important topic, was highly exploited by the Yahapalana

coalition to come to power in 2015 and to remain in power during the

past three years. The coalition government describes ‘Rajapaksa Regime’

as debt driven and has caused an immense debt burden on the country and

its people. The Rajapaksa rule ended on 9th January

2015 and by that time (end of 2014) the total government debt stood at

Rs.mn. 7,390,899. The domestic and foreign debt components remained at

Rs.mn. 4,277,783 and Rs.mn. 3,113,116 respectively. As a result the debt

burden of the country, as a percentage to GDP, stood at 71.3%. The per

capita debt burden had reached Rs. 357,000 while the gap between per

capita income and per capita debt remained as Rs. 142,000. While

criticizing borrowings of the previous government, the present

government has borrowed surprising amounts. This encouraged the writer

to compare between the Rajapaksa and Sirisena debt regimes and to

inquire into the government debt scenario analyzing its economic

perspectives.

Government

debt, as an important topic, was highly exploited by the Yahapalana

coalition to come to power in 2015 and to remain in power during the

past three years. The coalition government describes ‘Rajapaksa Regime’

as debt driven and has caused an immense debt burden on the country and

its people. The Rajapaksa rule ended on 9th January

2015 and by that time (end of 2014) the total government debt stood at

Rs.mn. 7,390,899. The domestic and foreign debt components remained at

Rs.mn. 4,277,783 and Rs.mn. 3,113,116 respectively. As a result the debt

burden of the country, as a percentage to GDP, stood at 71.3%. The per

capita debt burden had reached Rs. 357,000 while the gap between per

capita income and per capita debt remained as Rs. 142,000. While

criticizing borrowings of the previous government, the present

government has borrowed surprising amounts. This encouraged the writer

to compare between the Rajapaksa and Sirisena debt regimes and to

inquire into the government debt scenario analyzing its economic

perspectives.

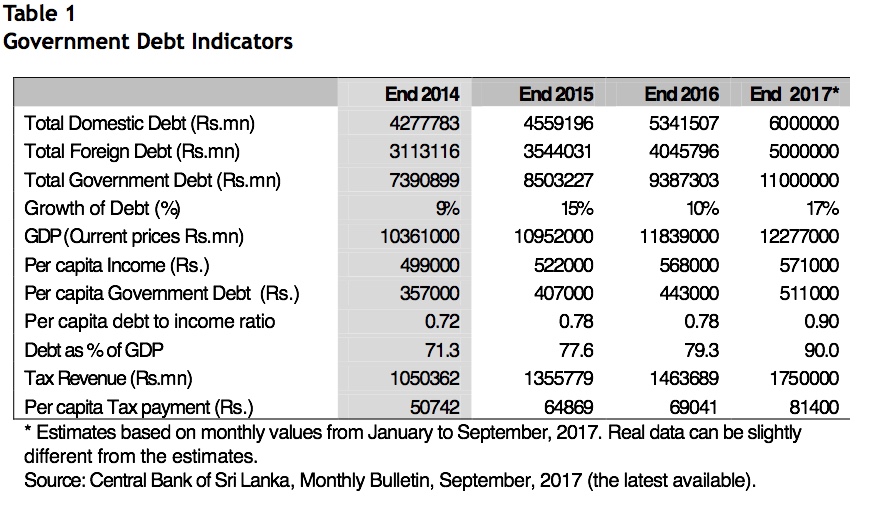

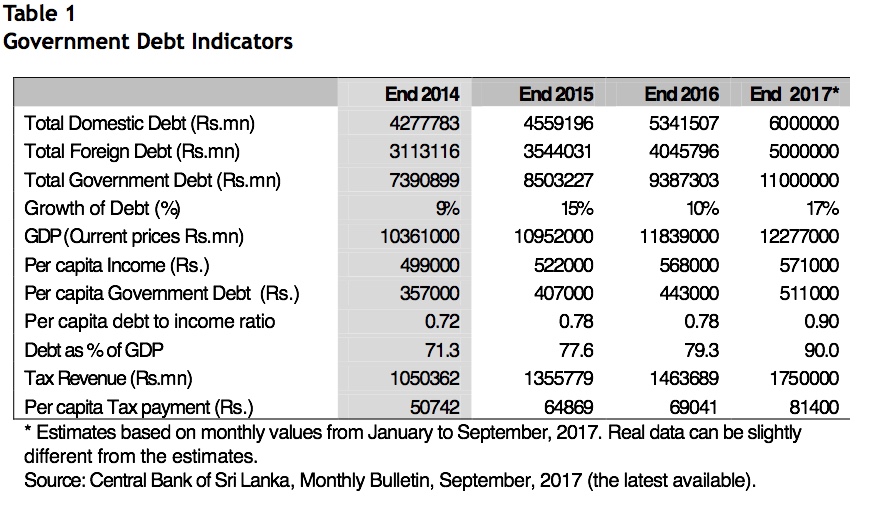

Table-1 indicates that the government debt burden

remained at 71.3% at the time of Rajapaksa’s defeat. New policy measures

that were introduced to overcome debt burden with effect from early

2015 have continued for good three years so far. In spite of debt

curtailing alleged by the new government, the debt burden has rapidly

increased from 71.3 to 79.3 within two years and it can be estimated,

based on government debt statistics reported by the Central Bank for

eight months until August 2017, that this figure would reach 90.0 by the

end of 2017. This indicates that the debt volume prevailed by the end

of 2014 would grow by an amount of Rs.mn. 4,000,000 making the total

debt as Rs.mn. 11,000,000 by the end of 2017. This is a growth of almost

50% since 2014 or all time total government debt.

During the same three year period, per capita income

has increased by Rs. 72,000 while per capita government debt has

increased by Rs. 154,000. This reveals that as the economic growth has

been much slower than the growth in borrowing. In consequence, the

government debt has outgrown the per capita income at a rate of more

than 200%. Therefore the gap between per capita income and per capita

government debt has narrowed significantly from Rs. 142,000 to Rs.

60,000 as indicated in the Figure-2. This explains that there is a debt

component of 90% in per capita income at present compared to 72% in

2014. The slow growth of per capita income is connected to economic

slowdown from 6% to less than 4% between in 2014 and 2017 due to

incapacity of the present economic policies. Increase in debt while

decrease in economic growth eventually leads to a debt trap.

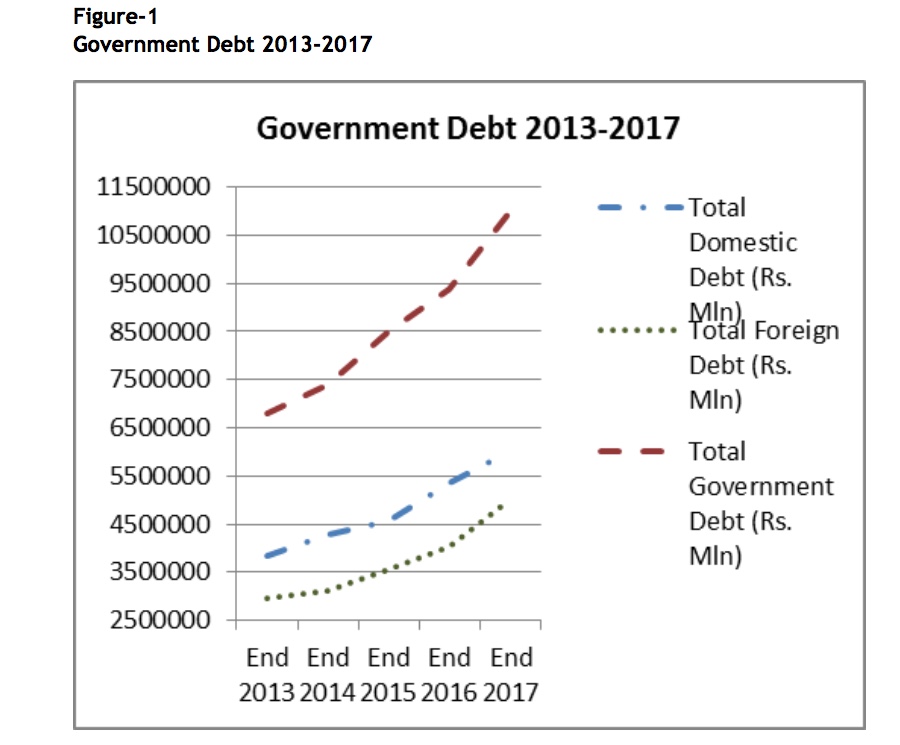

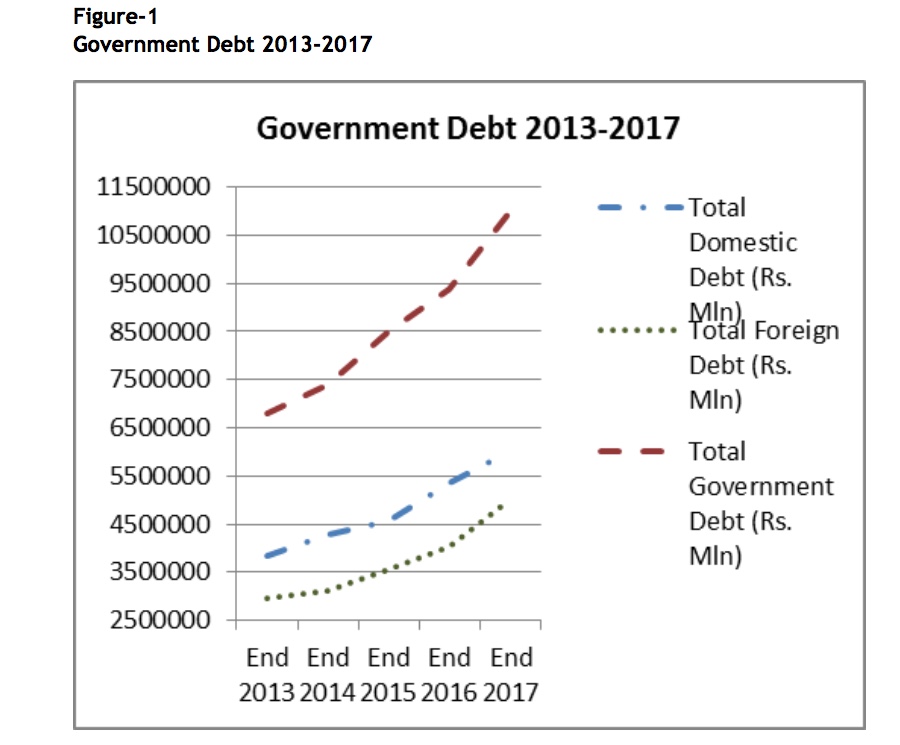

The foreign debt has grown faster than that of the

domestic debt between 2014 and 2017 which is much significant in 2017.

While domestic debt has increased from Rs.mn. 4,277,783 to

Rs.mn. 6,000,000 which is a growth of 40% foreign debt has grown from

Rs.mn. 3,113,116 to Rs.mn. 5,000,000 or 60% which is an alarming growth.

This is due to new debt as well as debt adjustments to depreciating

exchange rate of the Rupee. Sri Lankan rupee has depreciated from Rs.

130 per US$ to Rs. 155 per US$ by 18% during the past three year period

due to poor exchange rate management and unfavorable trade balance. The

increase in foreign debt component has not only intensified the debt

burden but has heavily increased external dependency also. The situation

has been aggravated by trade gap which in turn requires further foreign

borrowing to settle it.