A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Friday, September 28, 2018

Is it time for a rate cut?

Friday, 28 September 2018

Friday, 28 September 2018If you look at the successful economies of our region they have followed economic policies that are diametrically the opposite of what our nation state has followed. These economies had;

1. Low nominal interest rates

2. Competitive to slightly depreciated exchange rates

3. Low government deficits

By following these policies they were able to grow their exports and build prosperity.

We are unable to implement the preceding prescription as our Central

Bank more closely represent our political classes. Former governors and

governing hopefuls fill the paper with falsely-framed interpretations of

the facts and the current Governor says things that he lacks the

backbone to implement.

Monetary Policy Review no. 6 of 2018 is round the corner (2 October) and

it is strongly suggested that the Monetary Board unanimously consider

moving towards low nominal interest rates. Even a slight reduction would

be in the interests of the Central Bank.

It

must be noted that the Central Bank is moving towards inflation

targeting when setting rates and the implementation is due early next

year but there is nothing like the present to implement a good idea.

What is being suggested would also help smoothen out the shock to the

reduction in rates brought about by switching to inflation targeting. So

why reduce rates now? Three reasons.

It

must be noted that the Central Bank is moving towards inflation

targeting when setting rates and the implementation is due early next

year but there is nothing like the present to implement a good idea.

What is being suggested would also help smoothen out the shock to the

reduction in rates brought about by switching to inflation targeting. So

why reduce rates now? Three reasons.

1. To be in line

with declining

long-term rates

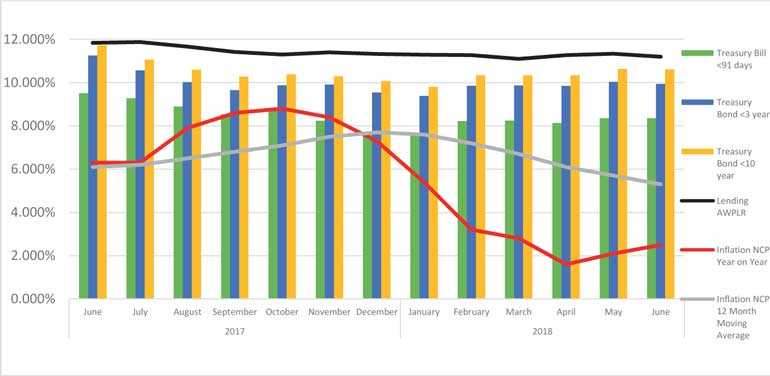

Rates, inflation, prime lending rates, and Government financing costs

are already on a declining long-term trajectory. Anyone saving for

retirement would be well served by buying out a mix of long-term rates

from the Government, a proxy State institution, or something too big to

fail.

Notably as a retail investor it is practically impossible to access the

Government debt markets. This is because of the lack of integration with

any accessible intermediary. More alarmingly, the DEX trading system

for corporate debt is also closed to retail investors. Atrad has the

inbuilt functionality to provide us access via their portal but have

been prevented by regulatory diktat.

Our Central Bank is often likened to the Catholic Church that prevented

people from engaging in finance. The structuring of the micro finance

bailout, wherein they guaranteed the return of the predatory lender,

would also suggest that they shared an anti-minority world view. There

is also no incentive to access the Government debt market as the

transmission of policy to the financial sector is very slow. That is to

say that lending institutions only amend their rates well after the

Central Bank has changed policy. Normal people do not hold Government

debt. It is a low-paying instrument. The institutions that hold

Government debt do so as they are required to do so by regulation. The

chart shows the holding of Government Treasury bonds.

As can be seen by the line graph the amount of Government issuance of

Treasury bonds is going down. This in conjunction with the amount of

funds that by regulatory decree have to hold government funds are

growing bigger. In my opinion this should then result in lower rates for

Government debt.

As there is little opportunity for me to share in the returns gained in

trading in this market I lack the drive to learn about it. The Central

Bank which recently claimed itself to be a knowledge society is actively

preventing me from seeking this knowledge. However as seen from the

data there has been a decline in rates.

2. Psychological

This rate announcement comes surrounding the buzz around the recent

decline the USD/LKR exchange rate. One must admit that certainty and

thereby confidence in the economy is slightly lacking. Many notable

economists argue that the Central Bank could have prevented a lot of

this speculation by offering government debt that guarantees a USD

computed return in locally denominated currency. That is to offer the

USD Treasury rate plus a risk premium paid in the equivalent LKR terms

made accessible to jittery exporters.

Though the Governor has done a commendable job in terms of communication

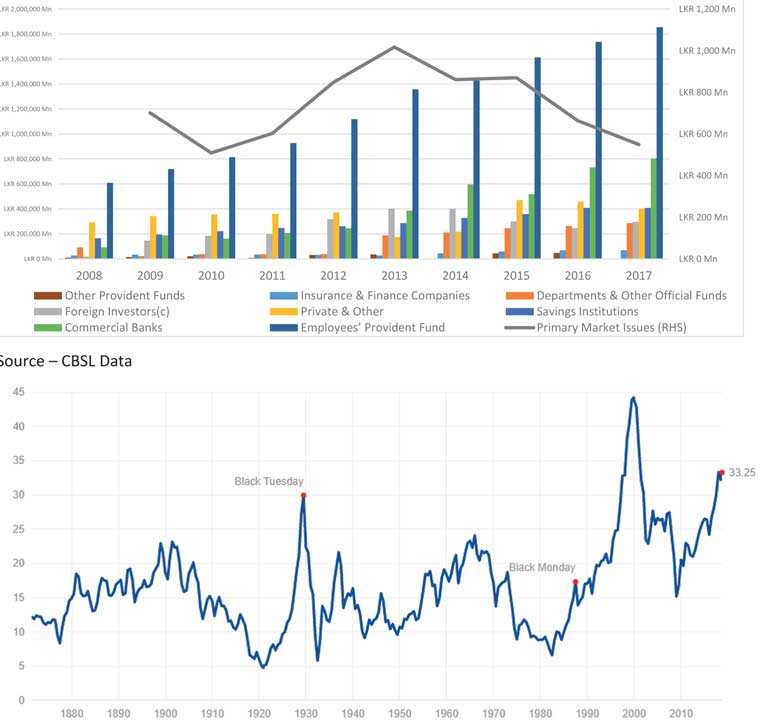

he must now also realise that his role is also motivational. The graph

tracks Robert Shiller’s PE ratio. Robert Shiller, of predicting the

housing bubble fame, now advises people to exit US equity markets as

they are overvalued.

It has never been a better time to invest in emerging markets as the

dollar is strong and those markets are currently highly undervalued.

People buy shares for their earnings and the US is currently very

expensive. Shiller argues that the growth in the US markets is due to

‘irrational exuberance’. This is driven by the Trump phenomenon.

Smart money would be leaving the US economy as we speak and Sri Lanka

should place itself to receive US funds when this madness eventually

crashes but in the meantime it would be beneficial to maintain some

level of stability. In this regard as Indrajit lacks the charisma to be a

motivational speaker, he could use interest rate movements to signal

confidence in the currency.

3. Because I said so

Both the Prime Minister and Mangala Samaraweera have publicly called for

a reduction in interest rates. Members of the Monetary Board would be

well served by heeding this call. Rates are invariably going to be lower

when targeting inflation becomes the objective of monetary policy and

the Central Bank has quite unequivocally stated that this will be coming

in early next year.

Rumour has it that the current Governor is not in good favour with the

two powerful green members and this would be an easy olive branch to

offer.