A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Wednesday, November 2, 2016

Monetary Board special session on Friday to discuss COPE report

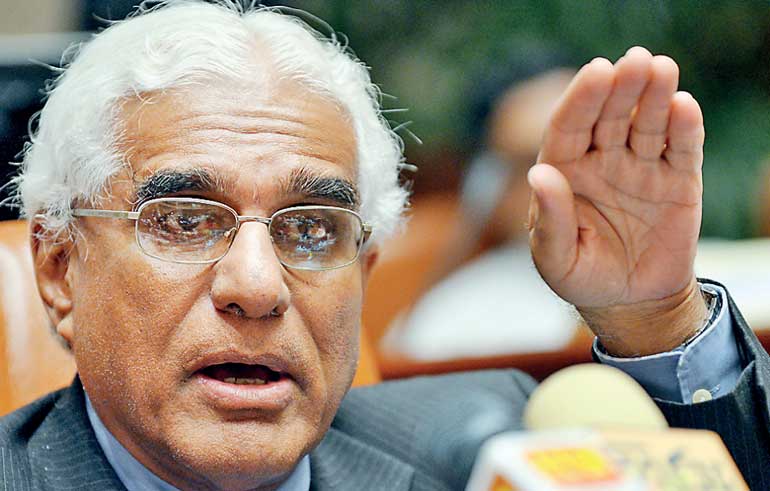

Central Bank Governor Dr. Indrajit Coomaraswamy – Pic by Shehan Gunasekara

The Monetary Board will meet on Friday for a special session to consider the three reports released on the bond scandal including the COPE report before deciding on future action, Central Bank Governor Dr. Indrajit Coomaraswamy said yesterday as the repercussions from the COPE report continued to unfold.

The Monetary Board, which would be meeting for the second time this week, will analyse the ‘onsite examination report’ conducted by the Central Bank of primary dealer Perpetual Treasuries, the Committee on Public Enterprises (COPE) report and the document compiled by the special committee appointed by Prime Minister Ranil Wickremesinghe when initial allegations of the bond scam erupted last year.

An early draft of the onsite examination report, which was leaked to the media, indicated, among much else, that profits declared by the primary dealer could be underreported.

“The

Monetary Board will go where the evidence leads them. Overall we know

that this is not a desirable set of circumstances,” Dr. Coomaraswamy

acknowledged, pointing out the Central Bank has already outlined a

number of measures including ending the Employees Provident Fund (EPF)

trading in the secondary market, and establishing a Bloomberg system

that tracks transactions in real time.

“The

Monetary Board will go where the evidence leads them. Overall we know

that this is not a desirable set of circumstances,” Dr. Coomaraswamy

acknowledged, pointing out the Central Bank has already outlined a

number of measures including ending the Employees Provident Fund (EPF)

trading in the secondary market, and establishing a Bloomberg system

that tracks transactions in real time.“We need to see what the situation is. What do we have the power to do? What can we do?” he said, adding that the Monetary Board would pay special attention to the recommendations in the onsite report.

The Central Bank has also started a pre-bid brief to primary dealers and established an auction calendar. Central Bank officials appointed to oversight committees such as the tender board, technical committee and domestic debt management committee, have been shuffled around so natural firewalls are created in the decision-making process limiting the flow of information.

The Central Bank has also sought the expertise of the World Bank and the International Monetary Fund to improve the Bloomberg platform and Dr. Coomaraswamy told reporters the current auction-only system of the bond market could change depending on their recommendations. The Government had traditionally followed a mix of direct placements and auctions but the system shifted exclusively to auctions during the tenure of former Central Bank Governor Arjuna Mahendran.

“We will continue to improve the system. Different countries use different systems so we have to decide on the best system that would suite us, which is dependent on the maturity of our market,” he said.

The Central Bank will also become more aggressive on accountability and enforcement, insisted the Governor, admitting that authorities “could have perhaps done more” to pursue wrongdoers. This same tightening of oversight would apply to the finance industry where the Special Investigation Unit, previously mooted by the Central Bank, would be resuscitated with the approval of the National Policies and Economic Affairs Ministry under Prime Minister Ranil Wickremesinghe to contend with ‘ponzi schemes’ and other illegal financial dealings.

However, Dr. Coomaraswamy stopped short of agreeing to investigate his officials, adamant that such a move would only be justified if clear evidence was presented beforehand. “If there has been wrongdoing there has to be clear evidence. I don’t see how I can take action otherwise. If there has been insider trading then that has to be borne out by future investigations, then I will take action. I can play to the gallery but that is not fair by my colleagues.”