A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Friday, March 31, 2017

The Debt Trap – A myth, Reality Or Political Propaganda?

Leading up to the presidential elections in January 2015, national debt

was a major topic of discussion. It was considered as a major failure of

the Rajapaksa regime, and was used as political propaganda by the unity

government to influence voters. The objective of this article is to

understand the gravity of this issue.

Generally, national debt of any country is measured as a percentage of

its GDP. It reflects the ability of a country to repay its debt without

requiring further assistance. Any financial institution or a government,

prior to assisting a country considers two major factors. Present debt

level and the potential of growth. An article published by Business

Insider U.K. in Oct. 2015 listed out seventeen countries with the

highest debt levels. Below table gives the information together with GDP

growth of the countries. It

comes as a surprise that Japan ranks as number one. It’s the third

largest economy in the world. Bank of Japan currently has a negative

interest rate monetary policy aimed at spurring growth. It continues to

add stimulus in the form of mortgage backed securities and various other

tools. Thus, expanding the balance sheet of the central bank adding to

national debt. The above table also suggests, most of the countries do

not experience robust growth. This questions their ability to re-pay

debt. Does it mean the above countries are worse off than Srilanka?

Singapore is considered as the economic miracle of the last fifty years.

It was also one of the active participants from the Asian region to

negotiate the Trans Pacific Partnership (TPP) with the United States of

/America, a landmark trade agreement. Such is its economic presence in

the region. Do Srilankans enjoy a better quality of life than the

Singaporeans? It is worth noting, there are some European heavyweights

in the above table. Sluggish growth is a common factor. The European

Central Bank akin to the Bank of Japan currently adopts a very

accommodative monetary policy aiming to achieve economic growth. The

Federal Reserve of the United States of America raised rates in its last

policy meeting, only for the second time since the 2008 financial

crises. Almost a decade of accommodative monetary policy has ensured the

lowest unemployment rate (under 4%) since 2008. Has excessive debt

stopped America from being the largest economic superpower of the world?

The result of such monetary policy has led to vibrant capital markets.

Dow Jones is at record high levels akin to all major European indices.

The bull market in America is nearing a decade. It is often the case

with most of these countries that the capital market performance is a

fair reflection of the economy’s performance.

It

comes as a surprise that Japan ranks as number one. It’s the third

largest economy in the world. Bank of Japan currently has a negative

interest rate monetary policy aimed at spurring growth. It continues to

add stimulus in the form of mortgage backed securities and various other

tools. Thus, expanding the balance sheet of the central bank adding to

national debt. The above table also suggests, most of the countries do

not experience robust growth. This questions their ability to re-pay

debt. Does it mean the above countries are worse off than Srilanka?

Singapore is considered as the economic miracle of the last fifty years.

It was also one of the active participants from the Asian region to

negotiate the Trans Pacific Partnership (TPP) with the United States of

/America, a landmark trade agreement. Such is its economic presence in

the region. Do Srilankans enjoy a better quality of life than the

Singaporeans? It is worth noting, there are some European heavyweights

in the above table. Sluggish growth is a common factor. The European

Central Bank akin to the Bank of Japan currently adopts a very

accommodative monetary policy aiming to achieve economic growth. The

Federal Reserve of the United States of America raised rates in its last

policy meeting, only for the second time since the 2008 financial

crises. Almost a decade of accommodative monetary policy has ensured the

lowest unemployment rate (under 4%) since 2008. Has excessive debt

stopped America from being the largest economic superpower of the world?

The result of such monetary policy has led to vibrant capital markets.

Dow Jones is at record high levels akin to all major European indices.

The bull market in America is nearing a decade. It is often the case

with most of these countries that the capital market performance is a

fair reflection of the economy’s performance.

It

comes as a surprise that Japan ranks as number one. It’s the third

largest economy in the world. Bank of Japan currently has a negative

interest rate monetary policy aimed at spurring growth. It continues to

add stimulus in the form of mortgage backed securities and various other

tools. Thus, expanding the balance sheet of the central bank adding to

national debt. The above table also suggests, most of the countries do

not experience robust growth. This questions their ability to re-pay

debt. Does it mean the above countries are worse off than Srilanka?

Singapore is considered as the economic miracle of the last fifty years.

It was also one of the active participants from the Asian region to

negotiate the Trans Pacific Partnership (TPP) with the United States of

/America, a landmark trade agreement. Such is its economic presence in

the region. Do Srilankans enjoy a better quality of life than the

Singaporeans? It is worth noting, there are some European heavyweights

in the above table. Sluggish growth is a common factor. The European

Central Bank akin to the Bank of Japan currently adopts a very

accommodative monetary policy aiming to achieve economic growth. The

Federal Reserve of the United States of America raised rates in its last

policy meeting, only for the second time since the 2008 financial

crises. Almost a decade of accommodative monetary policy has ensured the

lowest unemployment rate (under 4%) since 2008. Has excessive debt

stopped America from being the largest economic superpower of the world?

The result of such monetary policy has led to vibrant capital markets.

Dow Jones is at record high levels akin to all major European indices.

The bull market in America is nearing a decade. It is often the case

with most of these countries that the capital market performance is a

fair reflection of the economy’s performance.

It

comes as a surprise that Japan ranks as number one. It’s the third

largest economy in the world. Bank of Japan currently has a negative

interest rate monetary policy aimed at spurring growth. It continues to

add stimulus in the form of mortgage backed securities and various other

tools. Thus, expanding the balance sheet of the central bank adding to

national debt. The above table also suggests, most of the countries do

not experience robust growth. This questions their ability to re-pay

debt. Does it mean the above countries are worse off than Srilanka?

Singapore is considered as the economic miracle of the last fifty years.

It was also one of the active participants from the Asian region to

negotiate the Trans Pacific Partnership (TPP) with the United States of

/America, a landmark trade agreement. Such is its economic presence in

the region. Do Srilankans enjoy a better quality of life than the

Singaporeans? It is worth noting, there are some European heavyweights

in the above table. Sluggish growth is a common factor. The European

Central Bank akin to the Bank of Japan currently adopts a very

accommodative monetary policy aiming to achieve economic growth. The

Federal Reserve of the United States of America raised rates in its last

policy meeting, only for the second time since the 2008 financial

crises. Almost a decade of accommodative monetary policy has ensured the

lowest unemployment rate (under 4%) since 2008. Has excessive debt

stopped America from being the largest economic superpower of the world?

The result of such monetary policy has led to vibrant capital markets.

Dow Jones is at record high levels akin to all major European indices.

The bull market in America is nearing a decade. It is often the case

with most of these countries that the capital market performance is a

fair reflection of the economy’s performance.

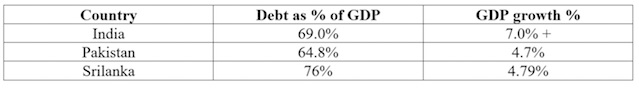

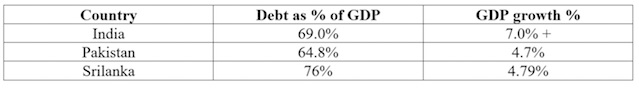

Now, let us look at Sri Lanka and some of its peers in the SAARC region. The below table provides the information. Comparing

India and Srilanka would not be right, two different economies with

different geographical settings and size. The difference is too much to

put it into perspective. Nonetheless, it’s worth mentioning that

compared to Sri Lanka, India faces far greater Economic development

challenges. It’s always vulnerable to socio-economic shocks more than

Srilanka. Its large domestic market acts as a shield against global

economic shocks. India’s growth is much driven not by its efficiency,

but by its sheer size of the domestic market. Domestic politics and the

media are two main obstacles to radical economic reforms. With Modhi in

power, things are looking much better on the economic front. Does debt

stop India from being the fastest growing major economy in the world?

Comparing

India and Srilanka would not be right, two different economies with

different geographical settings and size. The difference is too much to

put it into perspective. Nonetheless, it’s worth mentioning that

compared to Sri Lanka, India faces far greater Economic development

challenges. It’s always vulnerable to socio-economic shocks more than

Srilanka. Its large domestic market acts as a shield against global

economic shocks. India’s growth is much driven not by its efficiency,

but by its sheer size of the domestic market. Domestic politics and the

media are two main obstacles to radical economic reforms. With Modhi in

power, things are looking much better on the economic front. Does debt

stop India from being the fastest growing major economy in the world?

Comparing

India and Srilanka would not be right, two different economies with

different geographical settings and size. The difference is too much to

put it into perspective. Nonetheless, it’s worth mentioning that

compared to Sri Lanka, India faces far greater Economic development

challenges. It’s always vulnerable to socio-economic shocks more than

Srilanka. Its large domestic market acts as a shield against global

economic shocks. India’s growth is much driven not by its efficiency,

but by its sheer size of the domestic market. Domestic politics and the

media are two main obstacles to radical economic reforms. With Modhi in

power, things are looking much better on the economic front. Does debt

stop India from being the fastest growing major economy in the world?

Comparing

India and Srilanka would not be right, two different economies with

different geographical settings and size. The difference is too much to

put it into perspective. Nonetheless, it’s worth mentioning that

compared to Sri Lanka, India faces far greater Economic development

challenges. It’s always vulnerable to socio-economic shocks more than

Srilanka. Its large domestic market acts as a shield against global

economic shocks. India’s growth is much driven not by its efficiency,

but by its sheer size of the domestic market. Domestic politics and the

media are two main obstacles to radical economic reforms. With Modhi in

power, things are looking much better on the economic front. Does debt

stop India from being the fastest growing major economy in the world?