A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Monday, November 30, 2020

5 Big Picture Trends Being Accelerated by the Pandemic

As every email introduction has reminded us in 2020, we’re living in “unprecedented times”.

No doubt, even after a viable vaccine is released to the general public and things begin to return to some semblance of normalcy, there will be long lasting effects on society and the economy. It’s been said that COVID-19 has hit fast forward on a number of trends, from e-commerce to workplace culture.

Today, we’ll highlight five of these accelerating trends.

The following article uses charts and data from our new book Signals (hardcover, ebook) which covers the 27 macro trends transforming the global economy and markets. In some cases, where appropriate, we’ve added in the most recent projections and data.

#1: Screen Life Takes Hold

Smartphones have drastically altered many parts our lives – including how we spend time. In the decade from 2008 to 2018, screen time on mobile devices increased 12x.

|

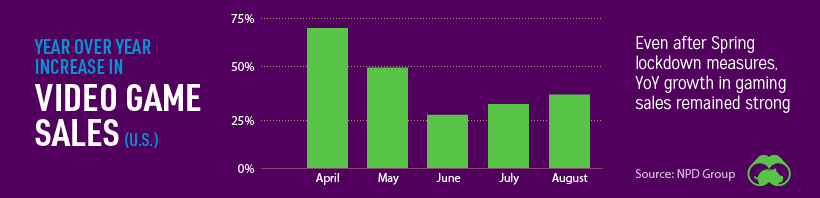

Gaming is another digital segment that has benefited from the pandemic. Video game revenue spiked in the springtime, and sales have remained strong going further into 2020. Companies are hoping that casual gamers won over during lockdown will continue playing once the pandemic has come to an end.

|

|

#2: The Big Consumer Shake-Up

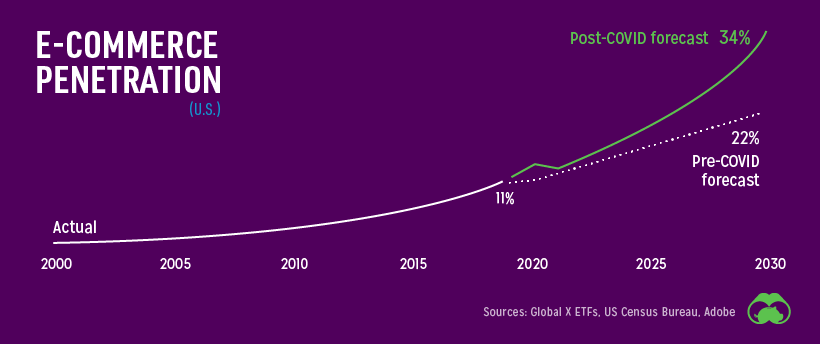

The consumer economy has been innovating on two fronts: making physical buying as “frictionless” as possible, and making e-commerce as nimble as possible. COVID-19 broke old habits and sped up that evolution.

Innovations in real world shopping appear to be moving in the direction of cashierless checkouts, but in order for that model to work, people first need to embrace contactless payment methods such as mobile wallets and cards with tap payment.

So far, the pandemic has been an accelerant in moving people away from cash and pin-and-swipe credit cards in lagging markets. Once people get used to the convenience of contactless payments, it’s likely they’ll continue using those methods.

|

|

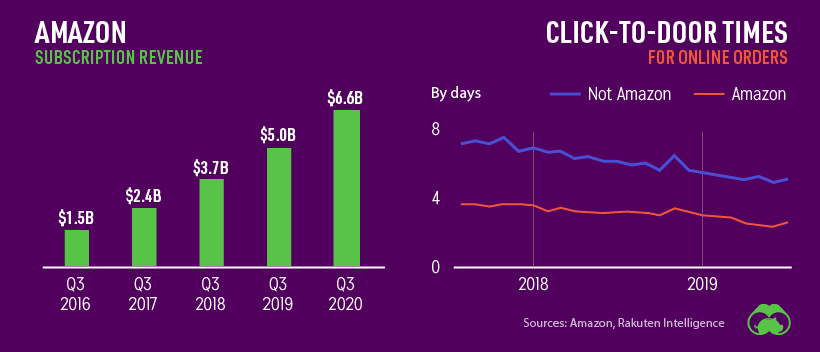

Much like the gaming industry, e-commerce companies like Amazon are hoping that people who dabbled with online ordering during the pandemic months, will convert into lifelong customers.

Acceleration signal: E-commerce penetration projections have shifted upward.

|

#3: Peak Globalization

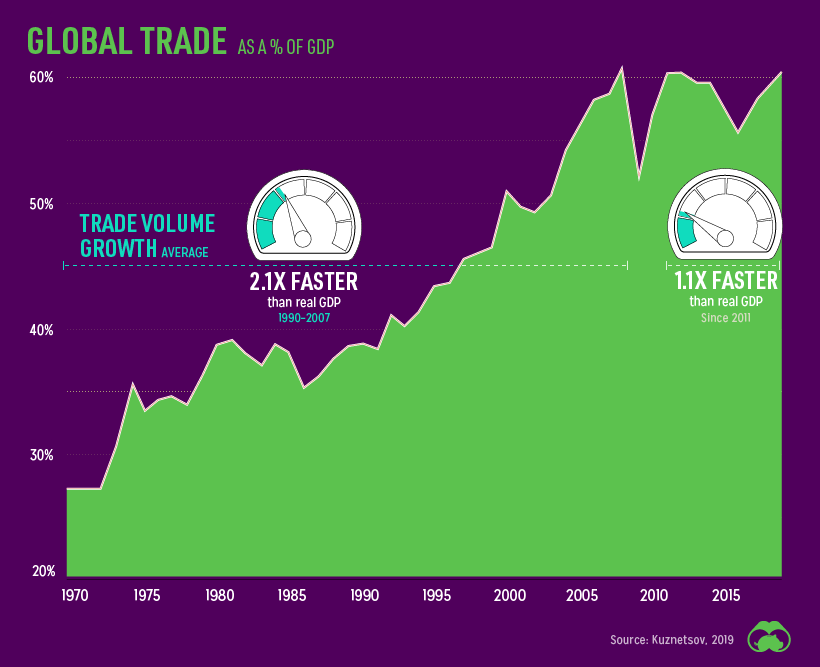

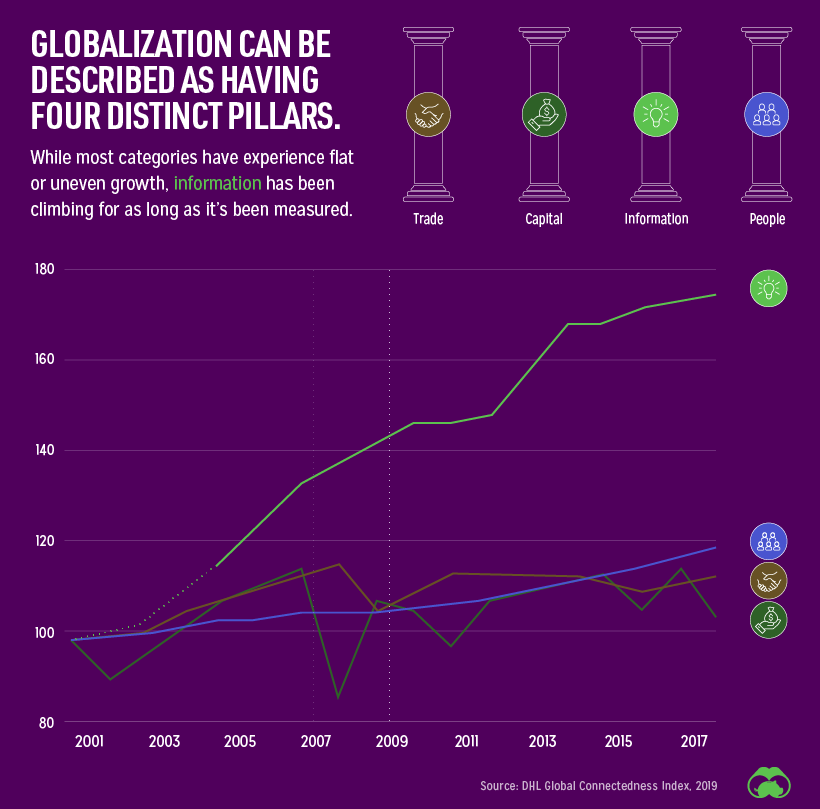

Globalization went on a tear starting from the mid-1980s until it hit a plateau during the financial crisis. Since that point, global trade as a percentage of GDP has flat-lined in the face of trade wars, and now COVID-19.

|

|

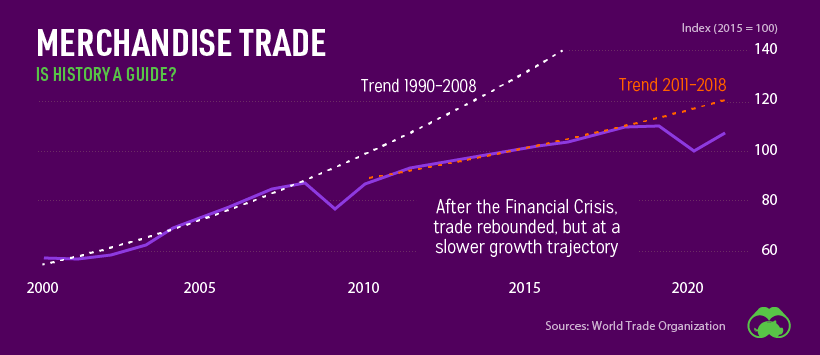

Acceleration signal: The dip in merchandise trade looks eerily similar to the one that took place in 2008.

|

| Add caption |

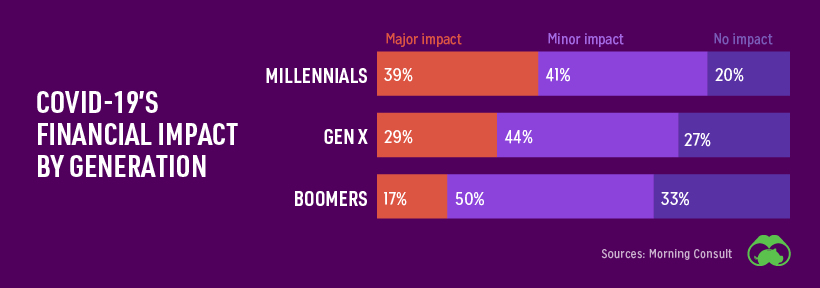

#4: The Wealth Chasm

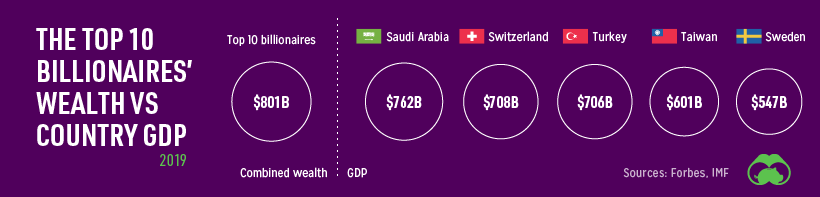

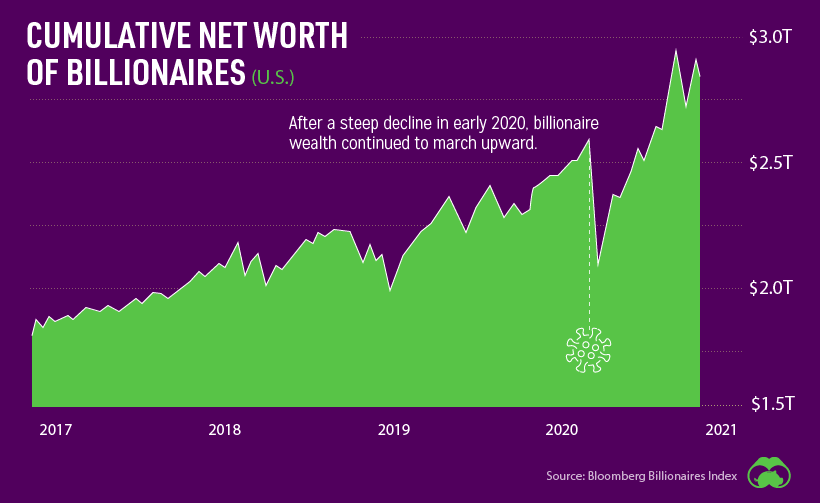

On the high end of the wealth spectrum, billionaires are worth more than ever.

|

Meanwhile, in the broader economy, inequality has grown over the last few decades. Those in the top 50% wealth bracket have seen increasing gains, while the bottom 50% have seen stagnation.

This issue is sure to be compounded by economic turmoil brought on by COVID-19. Younger generations face the dual challenges of being more likely to be negatively impacted by the pandemic, while also being the least likely to have savings to cover an interruption in income.

In fact, nearly half of people in the 18–24 year old age group have nothing saved at all.

|

The longer the economy is affected by COVID-19 measures, the more of a wedge will be driven between people who have continued working and those who are employed in impacted industries (e.g. tourism, events).

Acceleration signal: Growth in the net worth of billionaires has been largely unaffected by COVID-19.

|

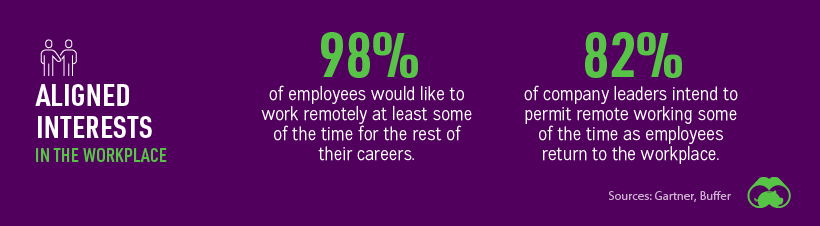

#5: The Flexible Workplace

As of 2019, over half of companies that didn’t have a flexible or remote workplace policy cited “longstanding company policy” as the reason. In other words, that is just the way things have always worked.

Of course, the pandemic has forced many companies to rethink these policies.

|

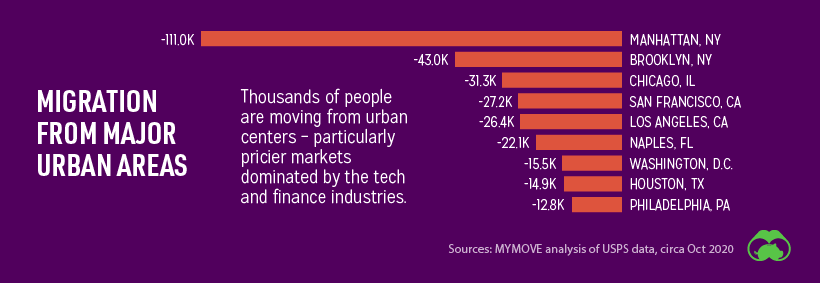

This grand experiment in remote work and distributed teams will have an impact on office life as we know it, potentially reshaping the entire “office economy”. The impact is already being felt, with global commercial property investment volume falling by 48% in Q3 2020.

Acceleration signal: Thousands of people are moving out of pricy urban areas, presumably because they are able to work remotely from a cheaper location.

|