A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Sunday, April 10, 2022

What the 2022 federal budget says about Canada’s commitment to a green recovery

Deputy Prime Minister and Minister of Finance Chrystia Freeland has left the door open to maintaining Canada’s position as a green leader among G20 nations. THE CANADIAN PRESS/Justin Tang

April 7, 2022

Every year, the federal budget outlines government spending priorities and sources of revenue for the coming year. While COVID-related spending dominated the previous two budgets, the 2022 budget comes amid new geopolitical uncertainties, including the war in Ukraine, ongoing socio-economic challenges in the wake of the pandemic, rising inflation, housing affordability, supply chain disruptions and increased pressure for accelerated climate action.

The federal government’s recently announced 2030 Emissions Reduction Plan, which aims to reduce greenhouse gas emissions to 40 to 45 per cent below 2005 levels by 2030, is expected to cost $9.1 billion in new investments, not including the cost of the investment tax credit for carbon capture and storage.

In our recent study, we find that Canada emerged as a leader among its G20 peers in terms of green fiscal stimulus spending and policies. Green fiscal stimulus aims to spur economic growth and create jobs while reducing emissions.

As we look at the 2022 budget released on April 7, we ask whether Canada will continue building on its green recovery commitment, as Chrystia Freeland promised to do when she took over the finance portfolio in August 2020. Today’s budget included over $12 billion in investments in lowering emissions over the next five years. These include electric vehicle infrastructure investments and purchase incentives, an expansion of the Low Carbon Economy Fund and a new tax credit for carbon capture, utilization and storage.

Budget 2022 is an opportunity for Canada to continue its leadership in green fiscal policy. It marks a critical juncture with Canada’s 2030 emissions reduction goals looming.

Canada emerges as a green stimulus leader

At the onset of the COVID-19 induced recession, academics, environmental advocates and multilateral institutions renewed their calls for a green fiscal response and to “build back better.”

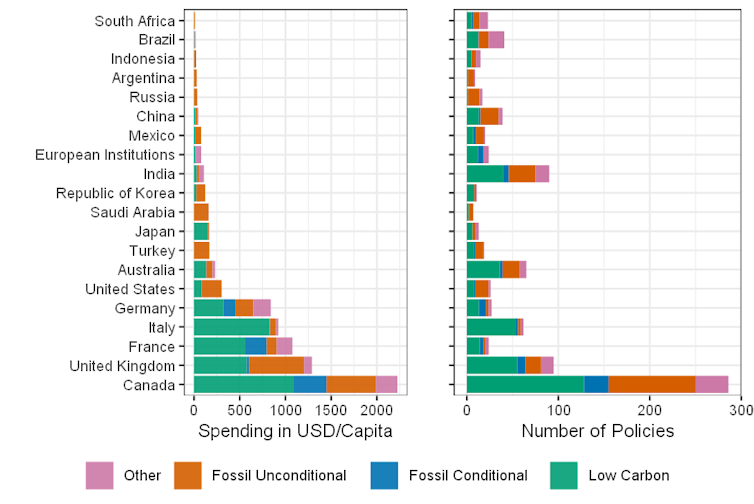

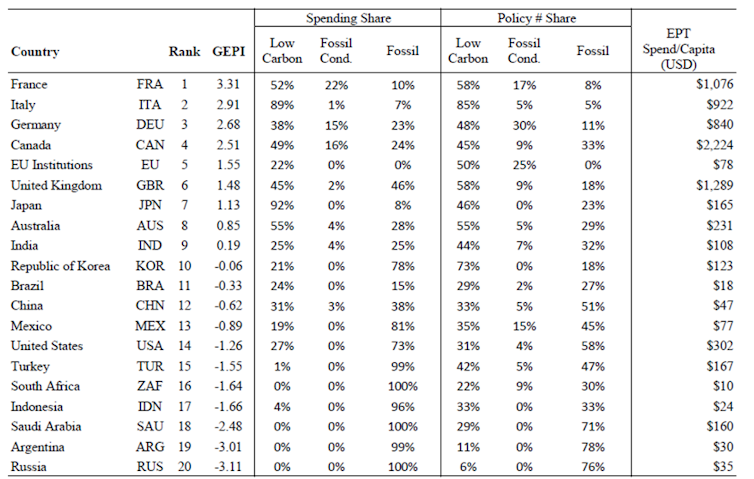

Our research analyzed more than 900 policies enacted by G20 nations from early 2020 until December 2021 using a novel dataset — the Energy Policy Tracker. Canada accounts for 286 of these policies, adding up to $113 billion (US$85 billion) and including both federal and provincial measures.

In the fight against the COVID-19 pandemic, Canada has emerged as a green recovery leader with the highest spending per capita on policies aimed at reducing emissions. Yet Canada, like other countries, also committed large amounts on policies supporting fossil fuels, called brown stimulus.

We constructed a Green Energy Policy Index (GEPI) that allows us to rank countries based on both green and brown stimulus measures using a more granular classification of policies that are low carbon, fossil conditional or fossil unconditional.

Low-carbon policies support the energy transition by increasing energy efficiency, lowering energy demand or supporting renewable energy. Examples include investments in transit, home retrofit programs that increase energy efficiency and investments in renewable energy and grid modernization projects.

Fossil-conditional policies support the fossil-fuel sector, but include conditions aimed at reducing emissions. One example is fuel switching, such as transitioning coal power plants to natural gas. A more controversial example is the program that provides up to $1.72 billion to some provinces and the industry-funded Alberta Orphan Well Association to support the cleanup of orphan and inactive wells. Some pandemic-related support for the aviation industry is classified as fossil conditional because recipients of the bailouts must follow climate-risk disclosure guidelines.

Fossil-unconditional policies support the fossil fuel sector with no conditions to aid the low-carbon transition. There are limited federal examples of such policies in our dataset. However, there is considerable provincial variation in fossil unconditional policies. One prominent example is the Alberta government’s $1.5 billion equity investment in the Keystone XL pipeline.

Taking into account the combination of all these measures, Canada ranks fourth among the G20.

The effectiveness of green stimulus

Global efforts to implement green stimulus measures emerged in the wake of the 2008-09 financial crisis. Such measures, aimed at stimulating a greener economic recovery, accounted for less than nine per cent of the total fiscal stimulus package in Canada, way below the G20 average of about 17 per cent.

Even among countries with large green fiscal stimulus packages, such as South Korea, these measures did not lead to reductions in emissions, likely because they were not backed up with meaningful long-term investments, carbon pricing or regulatory measures. Global emissions rebounded quickly.

Whether the pandemic-related green fiscal stimulus will be more effective is subject to future research. Our GEPI index can help answer that question in future studies. However, past country experiences from the global financial crisis highlight that green fiscal stimulus policies are complementary to carbon pricing and climate regulations.

An independent assessment of Canada’s recent emissions reduction plan suggests that over two-thirds of projected emissions reductions are attributed to the carbon tax and flexible regulations. Canada’s commitment to increase the carbon tax to $170 per tonne of carbon dioxide by 2030 put the country in the right direction, consistent with major climate scenario models, including work by the Bank of Canada, although more aggressive carbon pricing will be required beyond 2030 if we are to ensure a smooth transition to net zero by 2050.

Green spending in the federal budget

The new budget announced more than $12 billion in new green spending and other incentives that will make it more affordable for Canadians to adopt clean technologies over the next five years. This signals that Canada is continuing to build on its leadership in stimulating a green economic recovery. Note that spending levels are returning to normal as the economy recovers. For context, the data covered in our paper included over $60 billion in energy-related federal spending during 2020 and 2021 alone.

Today’s budget also introduced the $15 billion Canada Growth Fund, which has reducing emissions as one of its aims and more details on the highly anticipated investment tax credit for carbon capture, utilization and storage (CCUS), which is costed at $2.6 billion over the next five years. Lastly, the government announced a Critical Minerals Strategy aimed at developing the raw inputs required to meet increased demand for batteries.

Overall, the ability of these measures to help Canada achieve its 2030 emissions reduction goal will depend on two key factors. First, the government must implement previously announced complementary regulatory policies, such as the Clean Fuel Standard, quickly and maintain the rise in the carbon price. Second, these measures cannot be undone by future governments.

A clear path for climate policy is needed to encourage private sector investments and accelerate the low carbon transition of the Canadian financial system. This is vital since today’s budget estimates that Canada will require between $125 and $140 billion of annual investment to 2050 to meet our net-zero target.