A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Saturday, May 7, 2022

Charted: U.S. Consumer Debt Approaches $16 Trillion

Charted: U.S. Consumer Debt Approaches $16 Trillion

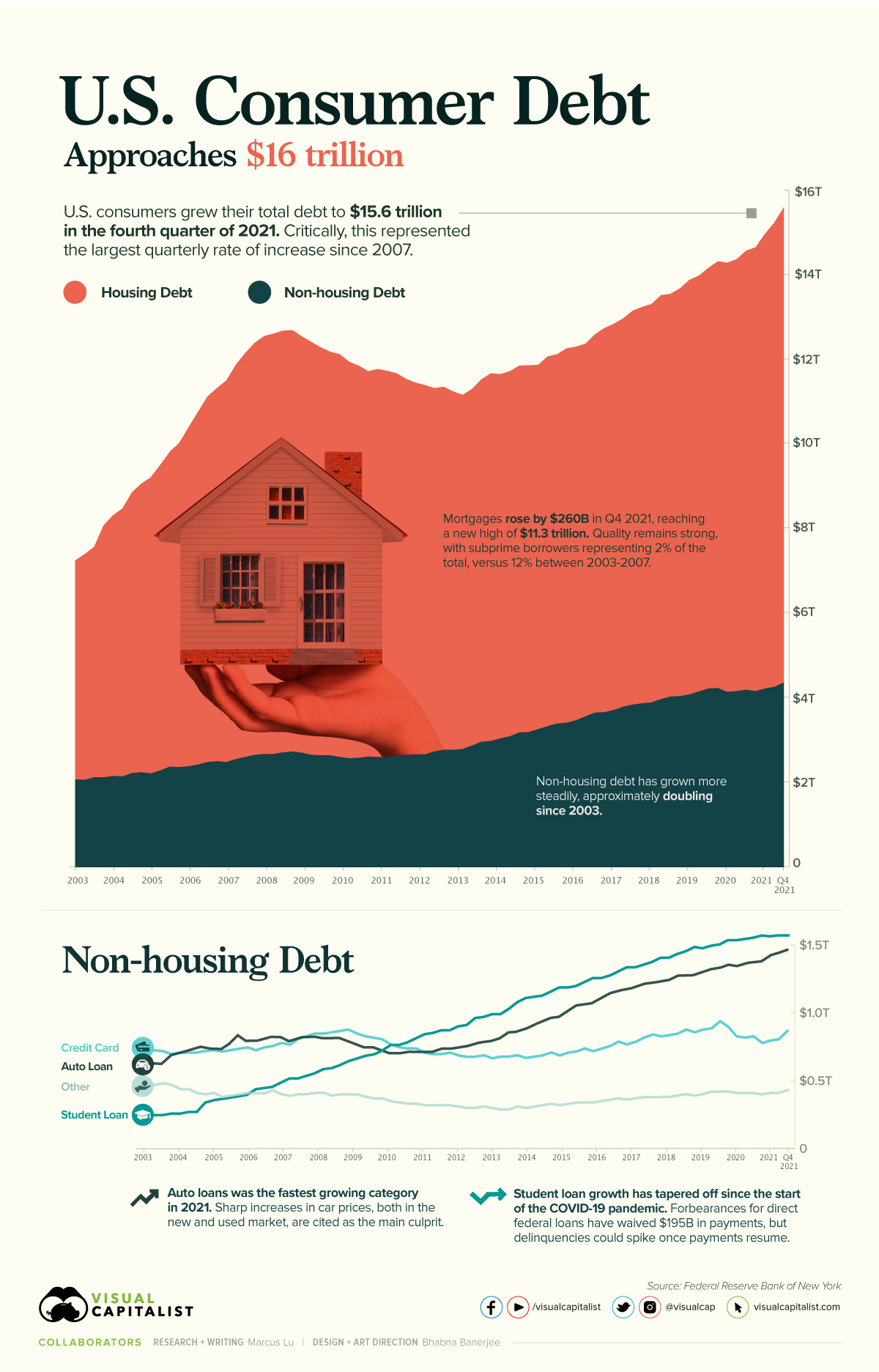

By Marcus Lu-According to the Federal Reserve (Fed), U.S. consumer debt is approaching a record-breaking $16 trillion. Critically, the rate of increase in consumer debt for the fourth quarter of 2021 was also the highest seen since 2007.

This graphic provides context into the consumer debt situation using data from the end of 2021.

Housing Vs. Non-Housing Debt

The following table includes the data used in the above graphic. Housing debt covers mortgages, while non-housing debt covers auto loans, student loans, and credit card balances.

| Date | Housing Debt (USD trillions) | Non-Housing Debt (USD trillions) | Total Consumer Debt (USD trillions) |

|---|---|---|---|

| Q1 2003 | 5.18 | 2.05 | 7.23 |

| Q2 2003 | 5.34 | 2.04 | 7.38 |

| Q3 2003 | 5.45 | 2.10 | 7.55 |

| Q4 2003 | 5.96 | 2.10 | 8.06 |

| Q1 2004 | 6.17 | 2.13 | 8.30 |

| Q2 2004 | 6.34 | 2.12 | 8.46 |

| Q3 2004 | 6.64 | 2.20 | 8.84 |

| Q4 2004 | 6.83 | 2.22 | 9.05 |

| Q1 2005 | 7.01 | 2.19 | 9.20 |

| Q2 2005 | 7.23 | 2.26 | 9.49 |

Showing 1 to 10 of 76 entries

Source: Federal Reserve

Trends in Housing Debt

Home prices have experienced upward pressure since the beginning of the COVID-19 pandemic. This is evidenced by the Case-Shiller U.S. National Home Price Index, which has increased by 34% since the start of the pandemic.

Driving this growth are various pandemic-related impacts. For example, the cost of materials such as lumber have seen enormous spikes. We’ve covered this story in a previous graphic, which showed how many homes could be built with $50,000 worth of lumber. In most cases, these higher costs are passed on to the consumer.

Another key factor here is mortgage rates, which fell to all-time lows in 2020. When rates are low, consumers are able to borrow in larger quantities. This increases the demand for homes, which in turn inflates prices.

Ultimately, higher home prices translate to more mortgage debt being incurred by families.

No Need to Worry, Though

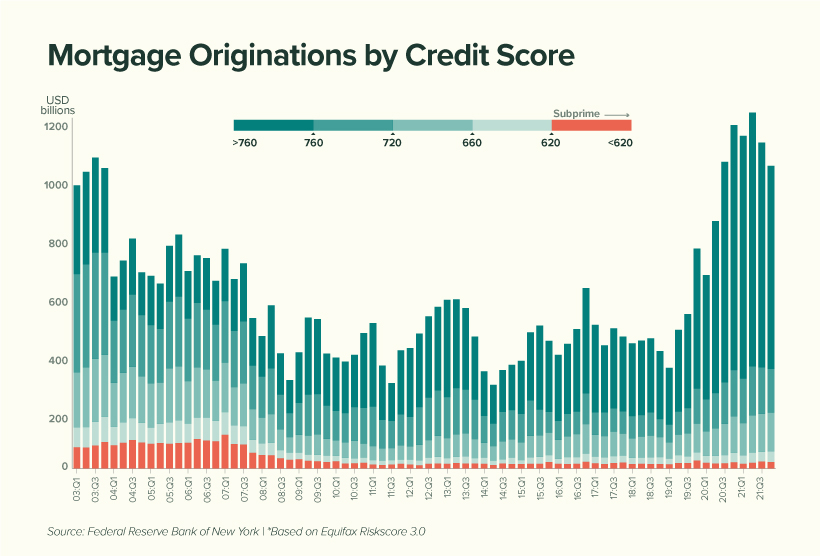

Economists believe that today’s housing debt isn’t a cause for concern. This is because the quality of borrowers is much stronger than it was between 2003 and 2007, in the years leading up to the financial crisis and subsequent housing crash.

In the chart below, subprime borrowers (those with a credit score of 620 and below) are represented by the red-shaded bars:

We can see that subprime borrowers represent very little (2%) of today’s total originations compared to the period between 2003 to 2007 (12%). This suggests that American homeowners are, on average, less likely to default on their mortgage.

Economists have also noted a decline in the household debt service ratio, which measures the percentage of disposable income that goes towards a mortgage. This is shown in the table below, along with the average 30-year fixed mortgage rate.

| Year | Mortgage Payments as a % of Disposable Income | Average 30-Year Fixed Mortgage Rate |

|---|---|---|

| 2000 | 12.0% | 8.2% |

| 2004 | 12.2% | 5.4% |

| 2008 | 12.8% | 5.8% |

| 2012 | 9.8% | 3.9% |

| 2016 | 9.9% | 3.7% |

| 2020 | 9.4% | 3.5% |

| 2021 | 9.3% | 3.2% |

Source: Federal Reserve

While it’s true that Americans are less burdened by their mortgages, we must acknowledge the decrease in mortgage rates that took place over the same period.

With the Fed now increasing rates to calm inflation, Americans could see their mortgages begin to eat up a larger chunk of their paycheck. In fact, mortgage rates have already risen for seven consecutive weeks.

Trends in Non-Housing Consumer Debt

The key stories in non-housing consumer debt are student loans and auto loans.

The former category of debt has grown substantially over the past two decades, with growth tapering off during the pandemic. This can be attributed to COVID relief measures which have temporarily lowered the interest rate on direct federal student loans to 0%.

Additionally, these loans were placed into forbearance, meaning 37 million borrowers have not been required to make payments. As of April 2022, the value of these waived payments has reached $195 billion.

Over the course of the pandemic, very few direct federal borrowers have made voluntary payments to reduce their loan principal. When payments eventually resume, and the 0% interest rate is reverted, economists believe that delinquencies could rise significantly.

Auto loans, on the other hand, are following a similar trajectory as mortgages. Both new and used car prices have risen due to the global chip shortage, which is hampering production across the entire industry.

To put this in numbers, the average price of a new car has climbed from $35,600 in 2019, to over $47,000 today. Over a similar timeframe, the average price of a used car has grown from $19,800, to over $28,000.

%20(1)%20(1)%20(1).png)