A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

A Brief Colonial History Of Ceylon(SriLanka)

Sri Lanka: One Island Two Nations

(Full Story)

Search This Blog

Back to 500BC.

==========================

Thiranjala Weerasinghe sj.- One Island Two Nations

?????????????????????????????????????????????????Monday, January 30, 2017

World Bank Distances Itself From Arjuna Mahendran’s Bond Scam

January 29, 2017

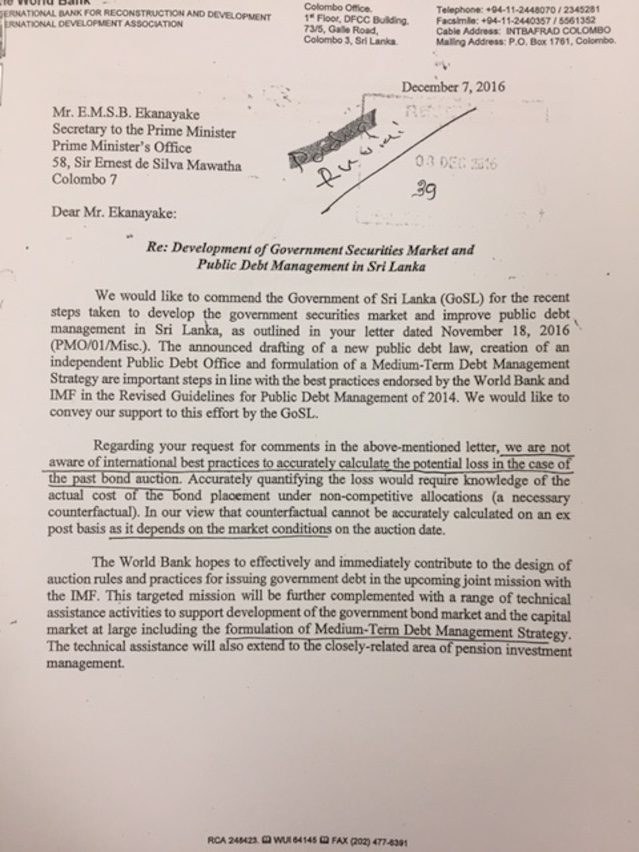

The World Bank has officially distanced itself from the controversial Central Bank bond scam committed by ex-Governor Arjuna Mahendran citing

that they are not aware of the international best practices to

accurately calculate the potential loss in the case of the past bond

auction.

In a letter addressed to M. S. B Ekanayake, Secretary to Prime Minister Ranil Wickremesinghe on

December 7, 2016, the World Bank Country Director to Sri Lanka Idah

Pswarayi-Riddihough referring to the letter sent by Ekanayake dated

November 18, 2016 said, “Regarding your request for comments in the

above mentioned letter, we are not aware of international best practices

to accurately calculate the potential loss in the case of the past bond

auction. Accurately quantifying the loss would require knowledge of the

actual cost of the bond placement under non-competitive allocations (a

necessary counterfactual). In our view that counterfactual cannot be

accurately calculated on an ex post basis as it depends on the marker

conditions on the auction date.”

In a letter addressed to M. S. B Ekanayake, Secretary to Prime Minister Ranil Wickremesinghe on

December 7, 2016, the World Bank Country Director to Sri Lanka Idah

Pswarayi-Riddihough referring to the letter sent by Ekanayake dated

November 18, 2016 said, “Regarding your request for comments in the

above mentioned letter, we are not aware of international best practices

to accurately calculate the potential loss in the case of the past bond

auction. Accurately quantifying the loss would require knowledge of the

actual cost of the bond placement under non-competitive allocations (a

necessary counterfactual). In our view that counterfactual cannot be

accurately calculated on an ex post basis as it depends on the marker

conditions on the auction date.”

Despite the World Bank officially distancing itself from the

controversial treasury bond scam which reportedly resulted in the

country losing Rs. 1.6 billion, several State-owned publications

including the Sunday Leader newspaper which is now run by Finance

Minister Ravi Karunanayake and Arjuna Mahendran’s Son-in-law Arjun Aloysius wrongfully

reported the story saying that the World Bank had claimed the

government had not suffered any losses as a result of the bond issue.

“The World Bank was of the opinion that the government has not suffered

any losses as a result of the bond issue. Wickremesinghe had submitted

to the World Bank all details pertaining to Treasury bond transactions

in Sri Lanka. The World Bank had praised the government on the actions

taken to control debt and its tax reforms proposals,” the Sunday Leader story published today (January 29, 2017) said.

The two page letter by the World Bank country director also said that

with the GOSL’s efforts and collaborative support from the World Bank,

the IMF, will no doubt held enhance transparency and competition in the

government and corporate bond markers, improve public debt management

and bring Sri Lanka in line with international good practice.

Meanwhile, an economic expert said that the World Bank artfully got away

from being a supporter of the scandalous bond transaction; under the

conditions which it has laid down in the last sentence of paragraph 2 of

the letter which says, one can easily calculate the potential loss; on

the day of the first bond transaction, the market price of 30 year bonds

was available which is a non-competitive bond price and except

Perpetual Treasuries, all other dealers including NSB bid at that price.

“Even the Bank of Ceylon (BOC) bid at that price (that is, Rs 120 per Rs

100 bond) when it had submitted bids for Janashakthi Insurance (Rs 500

million) and Kalutara Bodhi Society (Rs 8 million). But the very same

BOC after 10.57 am had bid at Rs 90 per Rs 100 bond on behalf of PTL in

three bids: one Rs 3 billion, and the other two Rs 5 billion each.

Harsha de Silva read this letter in Parliament and the government has

shamelessly prostituted World Bank into this issue. If the government is

interested, it can ask itself why it sold a bond that could have been

sold at Rs 120 per Rs 100 bond for Rs 90 and incurred an opportunity

loss of Rs 1500 million (that is: [(5000)/100]30 )in a single

transaction. It is not World Bank at error but the government which has

used an explanatory letter from World Bank for its own petty political

gains,” he said.